Discount retailer Five Below (NASDAQ:FIVE) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 4% year on year to $1.39 billion. Guidance for next quarter’s revenue was optimistic at $915 million at the midpoint, 2.2% above analysts’ estimates. Its non-GAAP profit of $3.48 per share was 3.3% above analysts’ consensus estimates.

Is now the time to buy Five Below? Find out by accessing our full research report, it’s free.

Five Below (FIVE) Q4 CY2024 Highlights:

- Revenue: $1.39 billion vs analyst estimates of $1.38 billion (4% year-on-year growth, 1% beat)

- Adjusted EPS: $3.48 vs analyst estimates of $3.37 (3.3% beat)

- Adjusted EBITDA: $296.6 million vs analyst estimates of $288.4 million (21.3% margin, 2.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $4.27 billion at the midpoint, beating analyst estimates by 0.7% and implying 10.2% growth (vs 9.9% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.41 at the midpoint, missing analyst estimates by 12.4%

- Operating Margin: 17.7%, down from 20.1% in the same quarter last year

- Free Cash Flow Margin: 22.4%, similar to the same quarter last year

- Locations: 1,771 at quarter end, up from 1,544 in the same quarter last year

- Same-Store Sales fell 3% year on year (3.1% in the same quarter last year)

- Market Capitalization: $4.07 billion

Winnie Park, CEO, said, “It has been a busy three months at Five Below. We are executing our key strategies around product, value and store experience, and doing so with a sharpened focus on our core customer – the kid and the kid in all of us. We have a unique opportunity to deliver amazing value across a curated assortment featuring consistent newness with simplified pricing. Our focus on affordability and value is not just a strategy; it’s a promise to our customers that Five Below is a place where they can find joy and excitement at WOW prices. This is the true magic of Five Below.”

Company Overview

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $3.88 billion in revenue over the past 12 months, Five Below is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

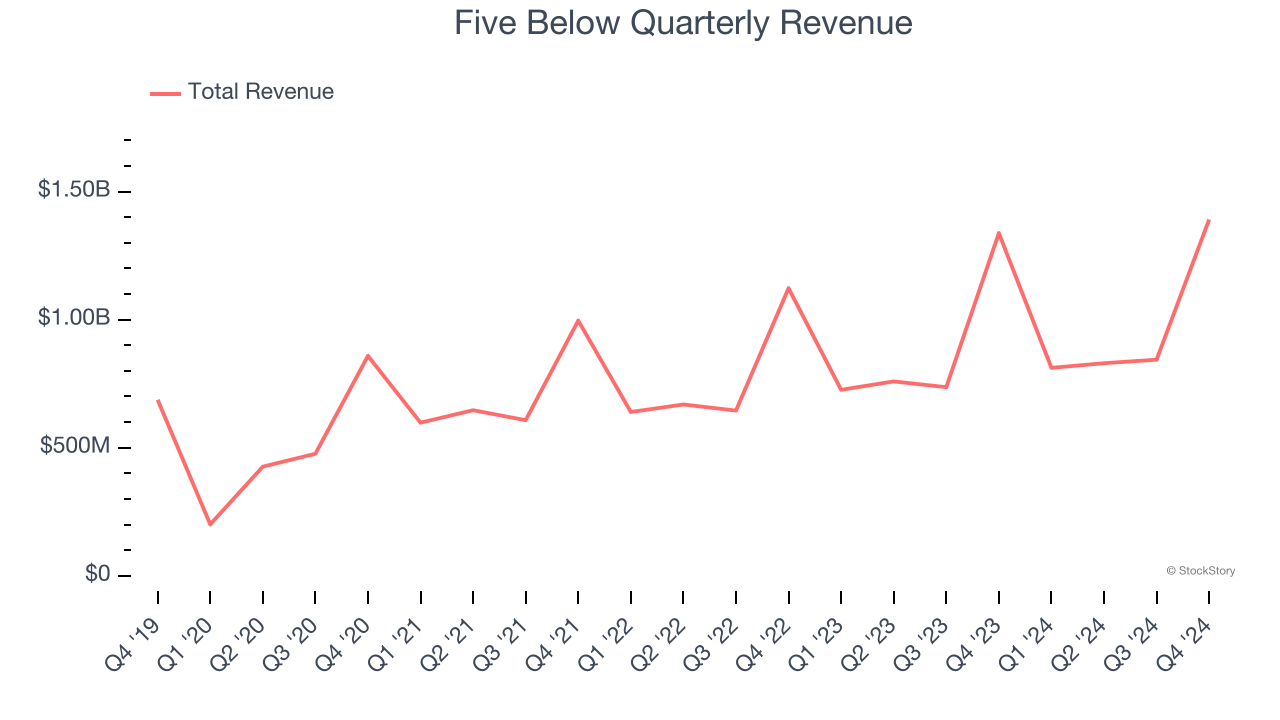

As you can see below, Five Below’s 16% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was impressive as it opened new stores and expanded its reach.

This quarter, Five Below reported modest year-on-year revenue growth of 4% but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 12.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, a deceleration versus the last five years. Despite the slowdown, this projection is admirable and implies the market is forecasting success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

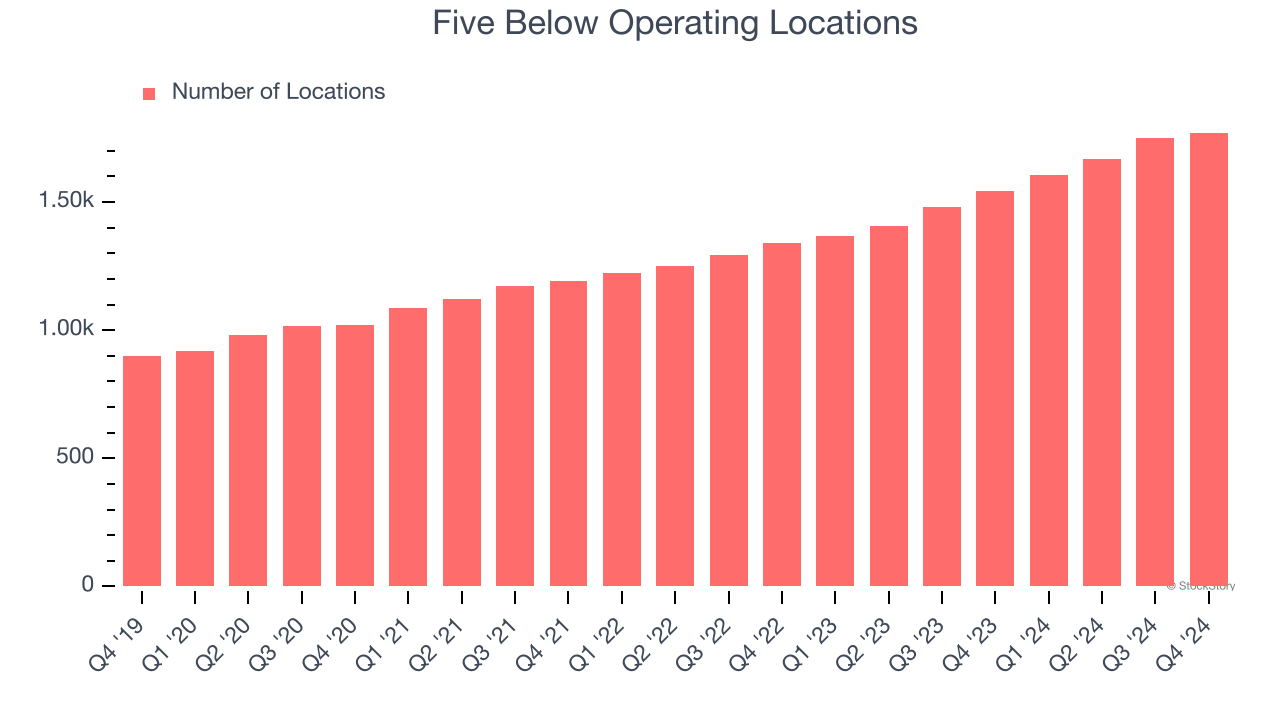

Five Below operated 1,771 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 15.3% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

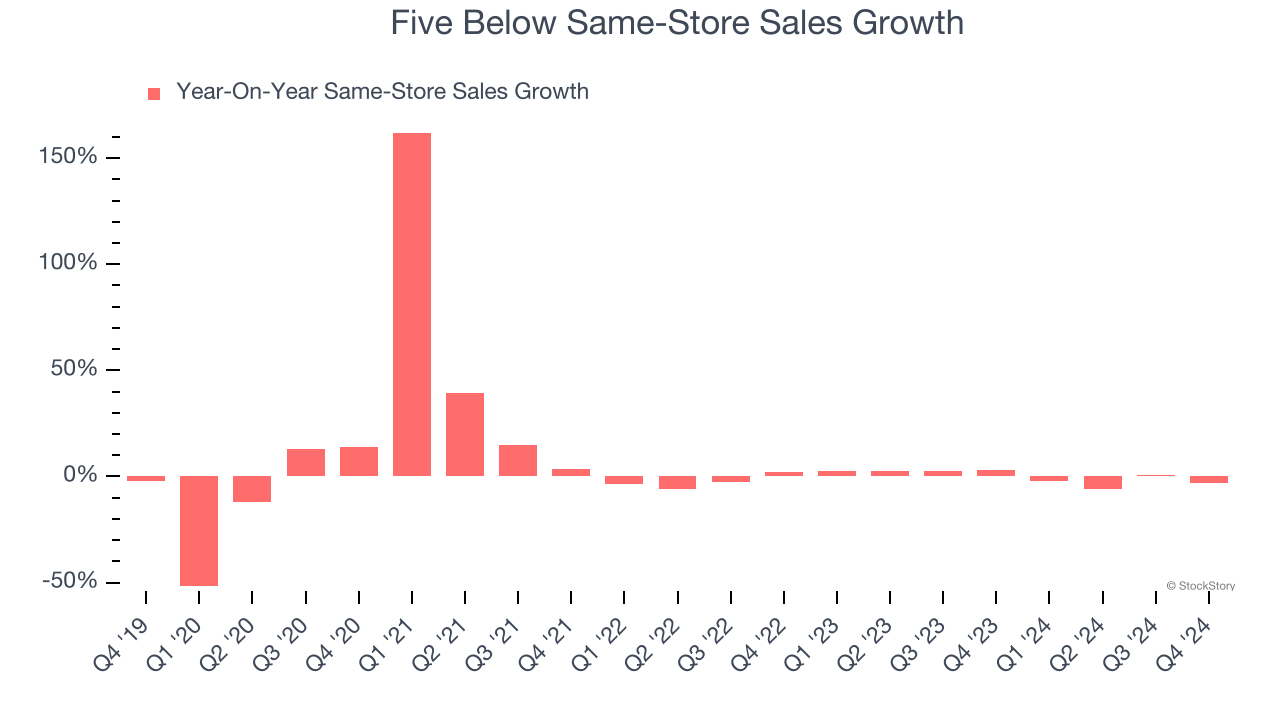

Five Below’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Five Below should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Five Below’s same-store sales fell by 3% year on year. This decline was a reversal from its historical levels.

Key Takeaways from Five Below’s Q4 Results

We were impressed by Five Below’s revenue, EPS, and EBITDA beats this quarter. We were also glad its full-year revenue guidance slightly topped Wall Street’s estimates. On the other hand, its full-year EPS guidance missed significantly. Still, this quarter had some key positives. The stock remained flat at $76.26 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.