Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

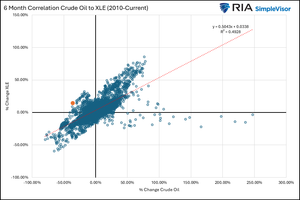

Over the last year, energy stocks have traded well despite crude oil prices languishing.

Via Talk Markets · January 29, 2026

Global markets kick off the day with a high risk and reflation tone following the Fed’s decision to hold rates steady, which reinforced expectations for a near-term pause and helped pressure the dollar.

Via Talk Markets · January 29, 2026

Via Talk Markets · January 29, 2026

Indian share markets are trading lower, with the Sensex trading 439 points lower, and the Nifty is trading 115 points lower.

Via Talk Markets · January 29, 2026

The FTSE100 inched higher in its ascending channel as prices close in on a record peak.

Via Talk Markets · January 29, 2026

The dollar has shown signs of stabilising, but has struggled to stay bid on Bessent’s ruling out JPY intervention and a slightly hawkish Fed.

Via Talk Markets · January 29, 2026

In January 2026, the Fed held rates at 3.50–3.75%, signaling

Via Talk Markets · January 28, 2026

Silver's 30-day implied volatility just broke 100%. I've been in this business a long time. I cannot name another liquid commodity product that has ever hit that level.

Via Talk Markets · January 28, 2026

Stocks are due for a pullback.

Via Talk Markets · January 28, 2026

Despite volatility from Microsoft and Meta earnings, the index is navigating a sub-minuette wave 4 correction, with gold and silver continuing their vertical, record-breaking rallies.

Via Talk Markets · January 29, 2026

AI infrastructure stocks like Arista and CoreWeave are surging. Backed by a $2.1B Nvidia investment, CoreWeave has spiked 40% this month, while Arista rides the 800G networking wave for hyperscalers like Meta.

Via Talk Markets · January 29, 2026

The Indian Rupee gains ground amid speculation of the RBI intervention, aiming to curb losses as the pair touched a fresh all-time high of 92.19 on January 28.

Via Talk Markets · January 29, 2026

can the tech titan’s results push some life back into shares? Let’s take a closer look at revisions and a few other key metrics to keep an eye on.

Via Talk Markets · January 29, 2026

META stock appears attractive as a long-term holding also because the titan issued solid guidance for its current quarter. In Q1, it sees sales coming in at $55 billion, well above the Street at $51.41 billion.

Via Talk Markets · January 29, 2026

The major European stock markets had a negative day today.

Via Talk Markets · January 28, 2026

Paymentus provides a cloud-based bill payment platform.

Via Talk Markets · January 28, 2026

The U.S. Dollar, which has lost a huge amount of value in the past year.

Via Talk Markets · January 28, 2026

In this video, we break down what the earnings report means for the stock technically, highlight key support and resistance levels, and outline a potential bullish trade setup that could emerge if the price holds or breaks through the right zones.

Via Talk Markets · January 29, 2026

Gold prolongs its record-setting rally for the ninth straight day and advances over 3% on Thursday, climbing to the $5,600 neighborhood during the Asian session.

Via Talk Markets · January 29, 2026

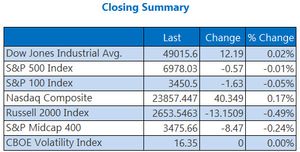

It’s a very newsworthy day on Wall Street today, with the biggest amount of consequential earnings reports — including three of the “Mag 7” — joining the latest FOMC meeting, where the Fed decided to keep rates steady as expected.

Via Talk Markets · January 28, 2026

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $63.60 during the Asian trading hours on Thursday.

Via Talk Markets · January 28, 2026

Oil markets continue to strengthen amid growing concern over a possible escalation between the US and Iran

Via Talk Markets · January 28, 2026

Cotton was higher after moving sharply lower the day before. Trends started to turn down on the daily reports.

Via Talk Markets · January 28, 2026

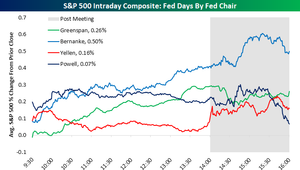

When it comes to stock market performance on Fed Days specifically, however, Powell's tenure has been the weakest of the

Via Talk Markets · January 28, 2026

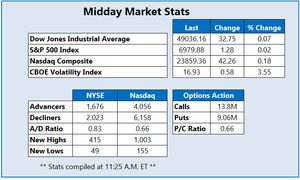

Stocks dipped early then reversed, reinforcing that this choppy, event-heavy market (FOMC + big tech earnings) favors quick intraday profit-taking over swing trends, with only a shaky USD bounce so far.

Via Talk Markets · January 28, 2026

AUD/USD extends its gains for the third successive session, trading around 0.7040 during the Asian hours on Thursday.

Via Talk Markets · January 28, 2026

Now that some of the dust has settled, we can take a look at earnings reactions.

Via Talk Markets · January 28, 2026

We have the perfect recipe for one of my all-time favorite trades setting up on the Nasdaq and Emini. I call them Slingshot Reversals, and I'm breaking down the entire strategy in tonight's video!

Via Talk Markets · January 28, 2026

In this video, Ira Epstein covers the latest developments in the metals market, focusing on the volatility and significant price movements in gold, which has reached unprecedented levels.

Via Talk Markets · January 28, 2026

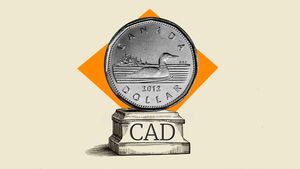

In January 2026, PM Mark Carney slashed tariffs on 49,000 Chinese EVs to 6.1% to save Canada’s canola exports from 85% duties. Trump threatened a 100% retaliatory tariff on Canada, while GM’s CEO warned of a

Via Talk Markets · January 28, 2026

We’re witnessing another stunning day in the gold and silver markets, as the gold futures are currently up over $265 on the session, while both the silver futures and spot price are back above $115.

Via Talk Markets · January 28, 2026

Stocks popped and flopped back to unchanged. VIX is wallowing, oblivious to the growing economic and geopolitical risks.

Via Talk Markets · January 28, 2026

The Fed left monetary policy unchanged in a range between 3.5% and 3.75%, but the accompanying statement and press conference suggested the Fed is more confident that the policy easing cycle is close to a conclusion.

Via Talk Markets · January 28, 2026

The personal savings rate in the US is approaching very low levels, near 3.5%. Savings levels were as high as 30% during COVID, but have decreased since then...

Via Talk Markets · January 28, 2026

Gold price surges to a fresh record high of $5,579 before retreating to around $5,500 in early Asian trading on Thursday.

Via Talk Markets · January 28, 2026

The S&P 500 finished the day flat ahead of a following uneventful Fed meeting that revealed little new beyond the view that the economy remains in reasonable shape.

Via Talk Markets · January 28, 2026

The MSCI Global Index closed up more than 21%, marking the sixth time in seven years with double-digit gains.

Via Talk Markets · January 28, 2026

The company said fourth-quarter revenue fell 3% from a year earlier to $24.9 billion, broadly in line with analyst expectations, bringing full-year sales to $94.8 billion, also down 3%.

Via Talk Markets · January 28, 2026

META's 2026 capex forecast was an absolute stunner: the company said that it anticipates 2026 capital expenditures to be in the range of $115-135 billion.

Via Talk Markets · January 28, 2026

Ethereum's price action could shift if the $2,750 support level fails.

Via Talk Markets · January 28, 2026

Micron Technology, Inc. stock has more than doubled from its low point a little over two months ago. That could be why there is unusual option activity in out-of-the-money MU puts expiring in just over 3 months.

Via Talk Markets · January 28, 2026

Humana investors may have suffered cardiac arrest yesterday after shares of the health insurer cratered 21% to close below $208 – the lowest level since early 2017.

Via Talk Markets · January 28, 2026

The US Dollar just printed fresh multi-year lows, while gold continues to ride strong bullish momentum.

Via Talk Markets · January 28, 2026

Technical analysis on the stock chart for NTRA.

Via Talk Markets · January 28, 2026

The S&P 500 touched 7,000 for the first time on Wednesday before settling just below breakeven.

Via Talk Markets · January 28, 2026

Microsoft posted adjusted earnings of $4.14 a share on revenue of $81.3 billion (better than expected earnings of $3.91 a share and revenue of $80.3 billion), beating across every segment.

Via Talk Markets · January 28, 2026

While Bitcoin legitimizes the blockchain ecosystem, Coinbase profits by operating the dollar rails that institutions actually use.

Via Talk Markets · January 28, 2026

U.S. equities tested fresh highs but struggled to build momentum as investors digested the Federal Reserve’s latest policy decision and a market rally that remained narrowly focused.

Via Talk Markets · January 28, 2026

No surprises.

Via Talk Markets · January 28, 2026

UnitedHealth Group experienced a significant sell‑off recently, causing technical levels that helped define the uptrend to break.

Via Talk Markets · January 28, 2026

Fed upgrades view of economy to say available indicators suggest economic activity “has been expanding at a solid pace”.

Via Talk Markets · January 28, 2026

Gold prices recently hit a record of $7,000 per ounce. These gold stocks give investors exposure to gold while also paying dividends.

Via Talk Markets · January 28, 2026

Investors should not be discouraged by any near-term pullback in gold prices, as the fundamentals underpinning the rally remain strong. Instead, they should adopt a

Via Talk Markets · January 28, 2026

In recent months, IREN has secured deals with major hyperscalers, positioning itself as a key player in a market projected to reach trillions.

Via Talk Markets · January 28, 2026

Nvidia stock rose early on Wednesday as investors welcomed signs of progress in the company’s access to the Chinese market, easing a key overhang that has weighed on the stock for months.

Via Talk Markets · January 28, 2026

The Japanese Yen remained unusually weak – or rather, the strength of the US Dollar against the Japanese currency was increasingly a thorn in the side of U.S. economic policymakers.

Via Talk Markets · January 28, 2026

The fixes may be quick, but they won’t do what Trump wants.

Via Talk Markets · January 28, 2026

This is the fifth consecutive year of structural deficits, projected to extend into a sixth. The cumulative drain has now approached 820 million ounces since 2021. The math has become destiny.

Via Talk Markets · January 28, 2026

The Bank of Canada held its policy rate at 2.25% as expected, reinforcing a cautious, wait-and-see stance amid lingering uncertainty.

Via Talk Markets · January 28, 2026

Palladyne AI shares jumped over 26% after the company announced a new contract with the U.S. Air Force Research Laboratory.

Via Talk Markets · January 28, 2026

The Dow Jones Industrial Average and S&P 500 Index are trading near breakeven, but the latter is fresh off another record, earlier crossing the 7,000 threshold for the first time.

Via Talk Markets · January 28, 2026

We’re getting close to the February natural gas expiration, which is going to create some extreme volatility, but March may play catch-up if the temperatures start to plummet again.

Via Talk Markets · January 28, 2026

The UK’s leading stock market index, the FTSE 100, suffered losses on Wednesday, weighed down by declines in banking and healthcare stocks.

Via Talk Markets · January 28, 2026

Telekom Austria combines modest price growth with a steady dividend, suggesting returns may come about equally from income and gradual share appreciation.

Via Talk Markets · January 28, 2026

Amazon is laying off about 16,000 more employees as it works to cut bureaucracy and respond to growing competition from AI.

Via Talk Markets · January 28, 2026

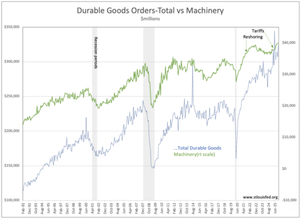

Taking out the volatile Aircraft orders, Durable Goods continues to reflect decent economic expansion. This is as expected and investors should maintain a positive equities outlook.

Via Talk Markets · January 28, 2026

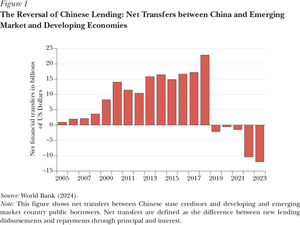

Lending from state-owned Chinese banks to developing countries took off around 2010.

Via Talk Markets · January 28, 2026

Australia’s CPI beat expectations, with services and housing inflation staying persistently above target, while labour data remains resilient. Together, these strengthen the case for a cautious 25bp RBA hike in February

Via Talk Markets · January 28, 2026

HYPEUSD approached key Fibonacci support during its ABC correction, and recent price action shows bulls regaining control, signaling potential further upside.

Via Talk Markets · January 28, 2026

The January regional Fed reports suggest that headline activity and new orders continue to improve, and at an improving pace (after a pause in December).

Via Talk Markets · January 28, 2026

The Australian Dollar is trading sideways against the US Dollar on Wednesday, as the Greenback finds some footing ahead of the Federal Reserve’s interest rate decision due...

Via Talk Markets · January 28, 2026

Google joins a $425M funding round for Redwood Materials to scale battery recycling and storage. This move supports a circular supply chain for EVs and renewable energy, aligning with Google’s goal for carbon-free operations by 2030.

Via Talk Markets · January 28, 2026

Automatic Data Processing, Inc. beat Q2 expectations with EPS of $2.62 and revenue of $5.4 billion, and raised its full-year outlook on continued business momentum.

Via Talk Markets · January 28, 2026