Alphabet-C (GOOG)

336.28

+1.28 (0.38%)

NASDAQ · Last Trade: Jan 28th, 4:29 PM EST

Detailed Quote

| Previous Close | 335.00 |

|---|---|

| Open | 336.61 |

| Bid | 337.99 |

| Ask | 338.22 |

| Day's Range | 332.13 - 337.63 |

| 52 Week Range | 142.66 - 341.20 |

| Volume | 16,748,817 |

| Market Cap | 224.51B |

| PE Ratio (TTM) | 33.20 |

| EPS (TTM) | 10.1 |

| Dividend & Yield | 0.8400 (0.25%) |

| 1 Month Average Volume | 19,377,310 |

Chart

About Alphabet-C (GOOG)

Alphabet Inc. is a multinational conglomerate primarily known for its role as the parent company of Google. It engages in a diverse range of activities, including internet search, digital advertising, software development, and hardware manufacturing. Alphabet's portfolio includes popular platforms and services such as YouTube, Google Cloud, and Android, as well as various initiatives in fields like artificial intelligence, autonomous vehicles, and health technology. The company's mission revolves around organizing the world's information and making it universally accessible and useful, while also exploring innovative solutions to enhance everyday life. Read More

News & Press Releases

If you can stomach volatility, the long-term potential remains strong.

Via The Motley Fool · January 28, 2026

The long-simmering tension between Silicon Valley’s generative AI ambitions and the survival of the British press has reached a decisive turning point. On January 28, 2026, the UK’s Competition and Markets Authority (CMA) unveiled a landmark proposal that could fundamentally alter the mechanics of the internet. By mandating a "granular opt-out" right, the regulator is [...]

Via TokenRing AI · January 28, 2026

Tesla had a poor 2025 but it's pivoting to two new and potentially massive industries. Is it worth a look for 2026?

Via The Motley Fool · January 28, 2026

The rise of artificial intelligence (AI) has only strengthened this tech powerhouse.

Via The Motley Fool · January 28, 2026

Google joins a $425M funding round for Redwood Materials to scale battery recycling and storage. This move supports a circular supply chain for EVs and renewable energy, aligning with Google’s goal for carbon-free operations by 2030.

Via Talk Markets · January 28, 2026

As of early 2026, the promise of a truly "personal" artificial intelligence has transitioned from a Silicon Valley marketing slogan into a localized reality. The shift from cloud-dependent AI to sophisticated edge processing has fundamentally altered our relationship with mobile devices. Central to this transformation are the Apple A18 Pro and the Google Tensor G4, [...]

Via TokenRing AI · January 28, 2026

Brookfield Renewable has high-powered total return potential in 2026 and beyond.

Via The Motley Fool · January 28, 2026

Jim Cramer sees Seagate's "multi-year build out" as a bullish indicator for Nvidia, Google, and Amazon following a strong Q2 earnings beat.

Via Benzinga · January 28, 2026

A fairy tale ending for quantum computing stocks likely isn't in the cards in 2026.

Via The Motley Fool · January 28, 2026

Both stocks are growing at similar rates and are trading at similar valuations, but one is still the clear winner when comparing the two.

Via The Motley Fool · January 28, 2026

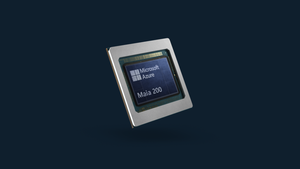

Microsoft released its in-house chip that will directly compete with Nvidia.

Via The Motley Fool · January 28, 2026

Looking for a hedge against any AI bubble that may or may not be forming? Centrus Energy is a good choice.

Via The Motley Fool · January 27, 2026

While AI chip stocks continue to garner outsize attention, smart analysts are looking elsewhere for growth.

Via The Motley Fool · January 27, 2026

These companies are cashing in on how people are using AI every day.

Via The Motley Fool · January 27, 2026

This "Magnificent Seven" company is establishing itself in the next frontier of technology.

Via The Motley Fool · January 27, 2026

The software giant is vying for a bigger piece of the AI pie.

Via The Motley Fool · January 27, 2026

As the world’s premier electric racing series enters its twelfth season, the intersection of high-speed performance and environmental stewardship has reached a new milestone. In January 2026, Formula E officially expanded its collaboration with Alphabet Inc. (NASDAQ: GOOGL), elevating Google Cloud to the status of Principal Artificial Intelligence Partner. This strategic alliance is not merely [...]

Via TokenRing AI · January 27, 2026

The quantum computing underdog faces tough near-term challenges.

Via The Motley Fool · January 27, 2026

Several billionaires on Wall Street are pouring into one particular member of the "Magnificent Seven."

Via The Motley Fool · January 27, 2026

As of January 2026, the long-predicted "Agentic Era" has arrived, moving the conversation from typing in text boxes to a world where we speak to our devices as naturally as we do to our friends. The primary battlefield for this revolution is the Advanced Voice Mode (AVM) from OpenAI and Gemini Live from Alphabet Inc. [...]

Via TokenRing AI · January 27, 2026

In the quest to cure humanity’s most devastating diseases, the bottleneck has long been the "wet lab"—the arduous, years-long process of trial and error required to find a protein that can stick to a target and stop a disease in its tracks. However, a seismic shift occurred with the maturation of AlphaProteo, a generative AI [...]

Via TokenRing AI · January 27, 2026

In a landmark shift for the global creative economy, Google has officially transitioned its flagship generative video model, Veo 3, from restricted testing to wide availability. As of late January 2026, the technology is now accessible to millions of creators through the Google ecosystem, including direct integration into YouTube and Google Cloud’s Vertex AI. This [...]

Via TokenRing AI · January 27, 2026

The tech giant may have some positive updates.

Via The Motley Fool · January 27, 2026

These companies are printing money from AI-powered ads.

Via The Motley Fool · January 27, 2026

Two of these players are trading at bargain valuations right now.

Via The Motley Fool · January 27, 2026