Coca-Cola Company (KO)

74.81

+1.38 (1.88%)

NYSE · Last Trade: Jan 30th, 5:40 PM EST

Detailed Quote

| Previous Close | 73.43 |

|---|---|

| Open | 73.71 |

| Bid | 74.68 |

| Ask | 74.78 |

| Day's Range | 73.54 - 74.90 |

| 52 Week Range | 62.35 - 74.38 |

| Volume | 26,347,659 |

| Market Cap | 322.38B |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 2.040 (2.73%) |

| 1 Month Average Volume | 17,150,744 |

Chart

About Coca-Cola Company (KO)

The Coca-Cola Company is a global leader in the beverage industry, renowned for its portfolio of soft drinks, juices, teas, coffees, and water products. Headquartered in Atlanta, Georgia, the company focuses on manufacturing, marketing, and distributing non-alcoholic beverages, with its flagship product being the iconic Coca-Cola soft drink. With a commitment to sustainability and innovation, Coca-Cola continually expands its offerings to meet consumer preferences, emphasizing healthier options and environmentally friendly practices. The company operates in numerous markets worldwide, leveraging its extensive distribution network to ensure that its products are accessible to a diverse range of consumers. Read More

News & Press Releases

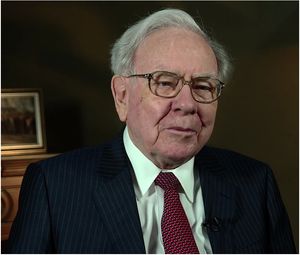

Warren Buffett warns investors it's better to own a smaller portion of a good thing than the entirety of something worthless.

Via Barchart.com · January 30, 2026

This Dividend King doesn't go on sale very often, but it currently has an above-market yield and a fair valuation.

Via The Motley Fool · January 30, 2026

Digital financial services company SoFi Technologies (NASDAQ:SOFI) announced better-than-expected revenue in Q4 CY2025, with sales up 38.7% year on year to $1.03 billion. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $1.04 million was less impressive, coming in 99.9% below expectations. Its non-GAAP profit of $0.13 per share was 16.1% above analysts’ consensus estimates.

Via StockStory · January 30, 2026

Telecommunications giant Verizon (NYSE:VZ) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 2% year on year to $36.38 billion. Its non-GAAP profit of $1.09 per share was 3.3% above analysts’ consensus estimates.

Via StockStory · January 30, 2026

Automotive safety systems provider Autoliv (NYSE:ALV) announced better-than-expected revenue in Q4 CY2025, with sales up 7.7% year on year to $2.82 billion. Its non-GAAP profit of $3.19 per share was 10.7% above analysts’ consensus estimates.

Via StockStory · January 30, 2026

The loss of the "Buffett premium" has put the shares on sale.

Via The Motley Fool · January 30, 2026

Here's how its dividend could grow 12-fold from today's levels.

Via The Motley Fool · January 30, 2026

Coca-Cola has established a track record of success.

Via The Motley Fool · January 30, 2026

iPhone and iPad maker Apple (NASDAQ:AAPL) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 15.7% year on year to $143.8 billion. Its GAAP profit of $2.84 per share was 6.4% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Shares of network testing solutions company Viavi Solutions (NASDAQ:VIAV) jumped 14.3% in the afternoon session after the company reported strong fourth-quarter 2025 results that beat expectations and provided an optimistic forecast for the upcoming quarter.

Via StockStory · January 29, 2026

Shares of boat and marine products retailer MarineMax (NYSE:HZO)

fell 8.8% in the afternoon session after the company reported a wider-than-expected loss for its fourth quarter, overshadowing a beat on revenue.

Via StockStory · January 29, 2026

Shares of financial technology provider SEI Investments (NASDAQ:SEIC) jumped 2.6% in the afternoon session after the company reported fourth-quarter financial results that surpassed analyst expectations for revenue and earnings.

Via StockStory · January 29, 2026

The Oracle of Omaha is familiar with the restaurant industry.

Via The Motley Fool · January 29, 2026

Global payments technology company Mastercard (NYSE:MA) met Wall Streets revenue expectations in Q4 CY2025, with sales up 17.6% year on year to $8.81 billion. Its non-GAAP profit of $4.76 per share was 12.3% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Water heating and treatment solutions company A.O. Smith (NYSE:AOS) missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $912.5 million. The company’s full-year revenue guidance of $3.96 billion at the midpoint came in 1.3% below analysts’ estimates. Its GAAP profit of $0.90 per share was 6.4% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Companies on this list have withstood the test of time.

Via The Motley Fool · January 29, 2026

Financial advisory firm Lazard (NYSE:LAZ) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 14.4% year on year to $929.4 million. Its non-GAAP profit of $0.80 per share was 16.2% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Industrial products company CSW (NASDAQ:CSW) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 20.3% year on year to $233 million. Its non-GAAP profit of $1.42 per share was 24.3% below analysts’ consensus estimates.

Via StockStory · January 29, 2026

Artificial intelligence (AI) software upgrades and the highly anticipated launch of the iPhone 18 are top of mind for Apple investors in 2026.

Via The Motley Fool · January 29, 2026

Bitcoin and XRP look like they are built to stand the test of time.

Via The Motley Fool · January 29, 2026

Freight Delivery Company ArcBest (NASDAQ:ARCB)

will be reporting earnings this Friday morning. Here’s what to expect.

Via StockStory · January 28, 2026

Electric vehicle pioneer Tesla (NASDAQ:TSLA) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 3.1% year on year to $24.9 billion. Its non-GAAP profit of $0.50 per share was 10.8% above analysts’ consensus estimates.

Via StockStory · January 28, 2026

Homebuilder NVR (NYSE:NVR) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 4.7% year on year to $2.71 billion. Its non-GAAP profit of $121.54 per share was 14.8% above analysts’ consensus estimates.

Via StockStory · January 28, 2026

Shares of website building platform Wix (NASDAQ:WIX) jumped 6.5% in the afternoon session after the company announced that its board of directors approved a new share repurchase program of up to $2 billion. The authorization covered a two-year period spanning fiscal years 2026 and 2027, allowing the company to buy back its ordinary shares and/or convertible notes. The company said the program was supported by strong cash generation from operations. This significant buyback plan signaled the board's confidence in Wix's ability to generate strong cash flow and its commitment to boosting shareholder value.

Via StockStory · January 28, 2026

Shares of computer processor maker Intel (NASDAQ:INTC)

jumped 10.2% in the afternoon session after reports surfaced that chip giants Nvidia and Apple were considering using Intel's foundry services for future chip production.

Via StockStory · January 28, 2026